Market Thoughts

Read on below for our most recent and past thoughts on Financial Markets and Legislation

It is very important to get advice on any of the following information before making decisions on what is right for you. In some cases the below general information may not be suitable to your circumstances and may even leave you worse off if not approached with the proper level of understanding.

November 2023 – Update

Markets

As many of you will no doubt be aware share markets have not been kind of late. This is the last 3 months here in Australia:

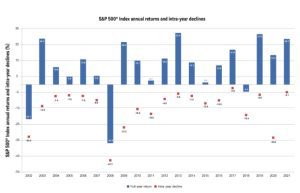

From the above you can see the local market is down almost 8%. This is not unusual fall over this time period. In fact, it is almost as common as not falling at all. Take this graph from the US S & P 500 (index of the American market effectively) for example:

Whilst the above is not the clearest graph, what is showing via the red markers is the fall during the year, whilst the blue lines show how the year actually ended. In the time period from 2001-2021, the US stockmarket experienced a drop during the year of over 10% every second year.

Coming back to the current climate, in the September quarter of 2023, global equity markets saw a significant reversal, wiping out a substantial portion of the June quarter gains in local currency terms. For Australian investors, the weaker Australian dollar helped to cushion the blow. The selloff was quite broad and affected most sectors. The biggest falls were in areas most sensitive to changes in real yields, such as utilities and real estate. Nevertheless, year-to-date, global equities maintained an overall positive trajectory.

At this point in time, we see no need for seismic changes to investment strategy. Many of our portfolios remain relatively cautious, with some cash available to deploy should buying opportunities present. Furthermore, all portfolios remain invested in quality investments, which time and time again, has proven to be the most effective strategy over the medium to long term.

We remain cautious on the outlook and anticipate further bumps in the road over the coming quarters. While the outlook (hard, soft or no landing) continues to be plagued with uncertainty, increased volatility is likely to continue. Overall, we prefer to maintain a defensive stance across the Portfolios, but note that any sharp sell-off could bring with it fresh investment opportunities.

If you have any questions, please don’t hesitate to contact either myself, Zoe or Leesa.

Regards, Derek

POWER2 The true value of financial advice

Does money make you happy? Yes! …. Wait what? Actually, a recent study found that it’s not about the amount of money, it’s about having control of your finances and future. Watch the attached video for their surprising results.

Date: 28-09-2016

What is the true value of financial advice?

It’s widely accepted that good financial advice offers clients a greater retirement lifestyle, improved personal security through effective insurance, better cash flow, the peace of mind of avoiding bad investments and greater discipline in sticking with good investments and budgets. Successful financial advice doesn’t just influence financial decisions though, it also influences client happiness, and it’s this underlying benefit which presents the true value of financial advice.

IOOF, in partnership with ‘effortless engagement’, took a closer look at these subtler benefits of financial advice in their white paper “The True Value Of Financial Advice” and uncovered….

Happier at home!

Respondents suggested that with ongoing financial advice there was greater harmony at home (one 2012 study found arguments about money were the strongest pointer to divorce of all disagreement types1) and lower levels of stress associated with purchasing decisions.

A perfect life?

One of the most compelling findings was that 22 per cent of people are more likely to feel they are living their ‘ideal life’ when they are backed by a successful financial plan and without the pressure or concerns surrounding money.

Get fit with financial advice!

The study also found that financial advice benefits extended beyond emotional happiness to clients’ physical health. The results were telling, with around 1 in 5 people who don’t receive financial advice reporting anxiety or disrupted sleep due to money concerns.

What else did the research show?

“The true value of Advice” paper showed that clients who receive ongoing financial planning advice experience:

• 13% greater levels of overall personal happiness.

• 21% overall increase in peace of mind.

• 17% increased level in confidence that their core goals will be achieved.

• 20% increased feeling of financial security.

One last point, Families come first

The research also found that family wellbeing was the top ranked priority, ahead of career, wealth and even personal health. In fact an overwhelming 83 per cent of clients consider it important for family members and close personal relationships to receive professional, ongoing advice.

If you would like a copy of IOOF White Paper ‘The true value of advice’ with the full results of their financial planning survey please contact our office.

1 Dew, J., Britt, S. and Huston, S. (2012), Examining the Relationship between Financial Issues and Divorce.

What are the two biggest tax scams this year?

Every day, good, intelligent folks are fooled by scammers using the latest technology and a fast tongue. Being up to date on some of the most common tax time scams may help you avoid their traps.

Date: 27-06-2019

Royal Banking & conflicted advice

Conflicted Advice? Royal Banking Commision? Advisers and Institutions being investigated?. How do we know who our “trusted” advisers are really working for? This animation attempts to provide a little clarity.

Date: 02-04-2019

Power 2 – Tax Refund Video

A quick video on the four most asked questions this year including the big one…”Will my tax refund be bigger?”

Date: 27-05-2020

Power2 – Open for Business

Away on holidays? Government got you locked down? Dont worry, Power2 is available. The above video explains how easy it is to stay in touch.

Date: 14-03-2020

Power2 – Putting your interests first

Its all about Ownership, Licencing and Fees

(Prefer to skip the reading and go straight to the talking? Call us on 4957 7574 and ask for Derek or Leesa.)

Ownership, Licencing and Remuneration

When you meet with us at Power2 to make decisions about your financial future you should feel comfortable that we have done our best to remove any bias from the room.

Power2 is a locally owned business with our own Australian Financial Services Licence (AFSL). We have no one telling us what to sell or how to charge.

If, like many firms out there, we worked for someone else or our licence belonged to someone else it only stands to reason that they are also going to be considered during the decision-making process.

Having our own licence and owning our own business means we can provide you with the right advice and avoid the conflicts that come when we have to include another parties’ interests.

Sales vs Advice

Although things are improving it is very true that “old school” financial advice was, and in many cases still is, sales based.

Many advisers either work for, or act as, agents of financial product providers. These can be insurance companies, fund managers, banks and others. The problem here is that the adviser and their licensee or owner have a joint interest in selling products rather than the adviser and their client deciding on strategy.

This arrangement has been the cause of many of the financial disasters we see in the news every day.

Power2 is a locally owned firm with its own AFSL. The owners of the business work in the business and work for you. Because we are not selling a product for, or on behalf of someone else, we can work together towards the best solution for you and your family.

The benefits of our own licence (AFSL)

Product provider supported advisers may only utilise their Licensee’s Approved lists which many times are overloaded with their licensee’s products.

This limits the options for you and quite often increases your costs.

Power2 can select products that suit your strategy from whichever provider suits your needs. Be it managed funds, shares or property, Power2 can examine your goals and objectives and find the best alternative for you at the lowest cost.

Fees and advice

The easiest way to work out who your adviser is really working for is to look at who is paying them.

At Power2 we make sure you know exactly how much we are receiving and where the funds are coming from.

In the case of your investments and our advice Power2 makes sure that we agree on your annual fee upfront every year and then provide you with several options for payment. You can arrange payment direct with us as a flat fee or the funds can come from your investments overtime.

When Power2 provides life Insurance advice, we are not limited in the array of choices available and will take you through the options carefully. Once the right policy is found we then allow you to choose between paying upfront, which is quite often cheaper, or in this instance only, and at your request, accept payment from the provider.

Power2 – Putting your interests first

In summary, the only way we believe a Financial Adviser can truly be working for you and you alone is when the advice, wherever possible, has no financial connection to any other party.

At Power2 we do our best to maintain a transparent, one on one relationship with you by pursuing, wherever possible, three basic tenets; Self Ownership, Self Licencing & Transparent, Non-conflicted Remuneration.

If you would like to discuss the above or your financial needs, please contact our offices or call and speak with Derek or Leesa.

Phone Scams at Tax Time

It is important to remember that the ATO do not threaten jail or arrest and do not email, call or SMS asking for credit card or bank details to issue refunds.

Every year, scammers impersonating ATO (Australian Taxation Office) employees attempt to obtain personal information for financial gain from you. Generally, phone scammers demand payment for an unexpected debt or offer an unexpected refund or grant.

Phone scammers are likely to be pushy or aggressive. They may tell you that there is a warrant out for your arrest or offer to send a taxi to take you to a post office so that you can make a payment. There is even a recent scam where the “Tax Office employee” wanted to be paid with I-Tunes Cards.

Besides money, scammers will try to collect personal information to steal your identity, be wary if you are being asked for any of the following:

- tax file numbers

- names

- addresses

- dates of birth

- myGov user name and password

- bank account and credit card details

- drivers licence, Medicare and passport details.

The above information is used or sold to other criminals to commit identity fraud. This can happen immediately or even months or years later.

The ATO has up to date info on their website here on recent and common scams .

31/07/2018 by The Power2 Team

Contact Us

Tax links and answers

We thought the following information on various tax issues would be useful to you. Personal circumstances always vary, so please ensure you contact us for specific advice.

(Now the Tax office loves to move their pages around so if you find a link that is not working, we apologise, feel free to let us know and we will get it up and running again ASAP!)